After a prolonged period of stagnation, Manhattan and Brooklyn are finally seeing a moderate recovery. However, the big question is, will this improvement last? As we reach the halfway point of this busy season, it’s clear that the market has been struggling, with 19 of the past 21 months showing below-average deal activity. Prices have been dropping by roughly 12% every year, yet inventory remains the same. Buyers are getting discounts close to 6% off original asking prices. Despite a hopeful start, rising mortgage rates and limited Fed rate cuts might slow things down this spring. Award-winning real estate agent from the Holt Real Estate team at Compass, Michael Holt pitches in with valuable insights about how to navigate this market.

Understanding the US Market Cycles with Michael Holt

The markets have definitely picked up compared to five or six months ago, possibly signaling the end of last year’s downturn. The key questions now are: How much further will the market rise, and is this surge in activity sustainable? Since spring 2022, above-average deal volumes haven’t been consistent. The gap between current market activity and typical seasonal levels has been shrinking, from 20% below in December 2023 to just 7% below by February 2024, thanks to declining mortgage rates. However, as rates started rising again in March, the deficit widened to 12%. With a deep understanding of these cycles, Michael Holt specializes in guiding both buyers and sellers through the complexities of the market.

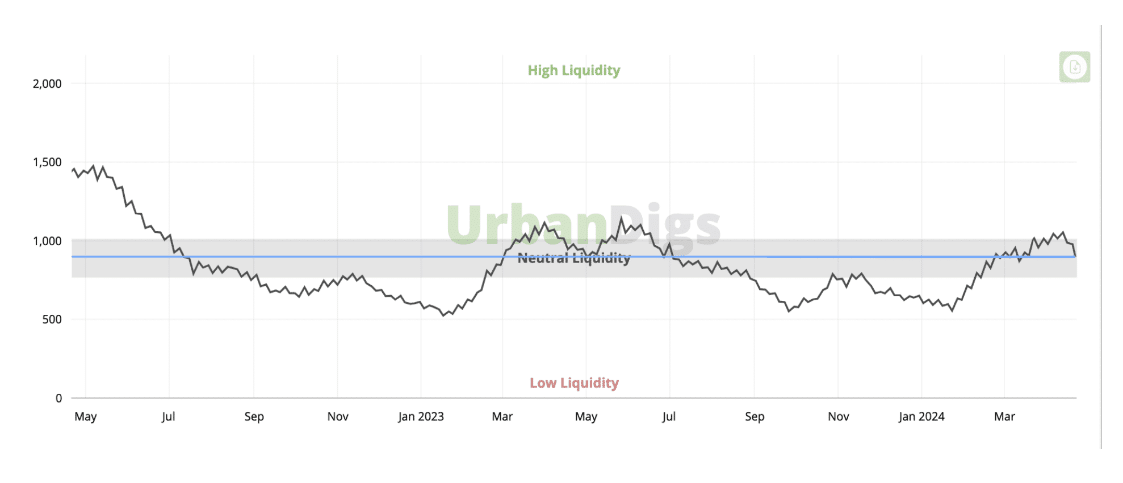

Market Liquidity Insights

The decline in market activity is evident when looking at market liquidity, measured by the rolling 30-day count of signed deals. Contracts increased with the spring season in February, but the momentum went down by March. By mid-April, buyers seemed to have paused, as liquidity dropped to a neutral level instead of staying above a thousand deals, which is expected until mid-June

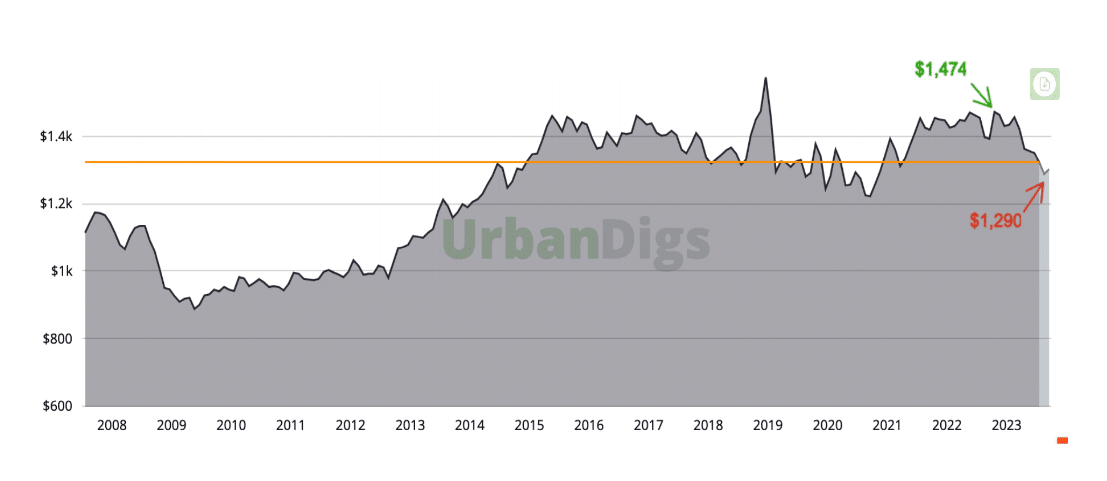

Price Trends and Recovery Signals

Recent closing data shows that the market, after a period of slowdown, is now bouncing back. The median price per square foot dropped 12% from its peak, going from $1,474/sq ft to $1,290/sq ft over the past four to five months. With the ongoing recovery, some of this decline has likely been recuperated, indicating a shift from a buyer-dominated market to a more balanced one. Despite this, it is getting increasingly unlikely that the Fed will cut interest rates this year. As a result, mortgage rates, which fell from October to December, have lately been rising again. This rise in rates could threaten the strength and duration of the seasonal market recovery.

Advice for Selling in Manhattan’s 2024 Market

The spring active season runs until early June, assuming no major disruptions. With rising rates, the remaining active months are expected to be lighter than usual, continuing a trend from recent years. Michael Holt advises that sellers should consider making important decisions early and adopt aggressive price reduction strategies to spark market interest before the season ends. Also, those listing later this year should be aware of potential risks such as election uncertainty, macroeconomic factors, interest rate fluctuations, stock market volatility, and the overall influence of market conditions due to these elements.

Advice for Buying in Manhattan’s 2024 Market

The market has bounced back from the lows of late last year, with buyers losing some leverage, but the pendulum might be swinging back as contract activity declines. Buyers with immediate needs are facing a neutral market with 6% negotiability, decent inventory, and recovering prices. For those who can wait, an early peak in the spring season could offer better leverage and pricing opportunities come summer.

In Conclusion

As the markets experience a modest recovery from the lows of late last year, moving towards a more balanced state, deal activity still remains below normal. Prices have dropped over the past year but are now starting to show signs of a slight rebound from last year’s lows. This isn’t a seller’s market. Given the current rates, which are a crucial factor in buyer confidence and activity, there is a lot of speculation if these conditions are as good as they will get for the spring season. In order to navigate such a fluctuating property market, expert guidance is crucial.

This is where nationally top 1% ranked real estate professionals like Michael Holt and team come in whose strategic advice can help make the most of the market conditions. The Holt Team exemplifies dedication to excellence and a passion for delivering outstanding real estate experiences.

Published by: Nelly Chavez