Recovering unclaimed money in the US is a process where individuals can reclaim money they have forgotten or lost track of. Unclaimed money can include forgotten bank accounts, insurance policies, refunds, and other financial assets.

Each state has its own unclaimed property program, which is responsible for holding and returning lost or forgotten assets to their rightful owners. For US residents to claim unclaimed money, they can search state databases and submit a claim with the necessary documentation.

As an industry worth over 100 billion dollars, could this be a worthwhile business opportunity for investors?

One company, Surplus Cashflow, is helping investors grow their cash flow with a 100% recession-proof surplus fund business, building a passive income stream for monthly cash flow. As a 100% done-for-you Surplus Fund income opportunity, the company passively brings investors 6 figures in income.

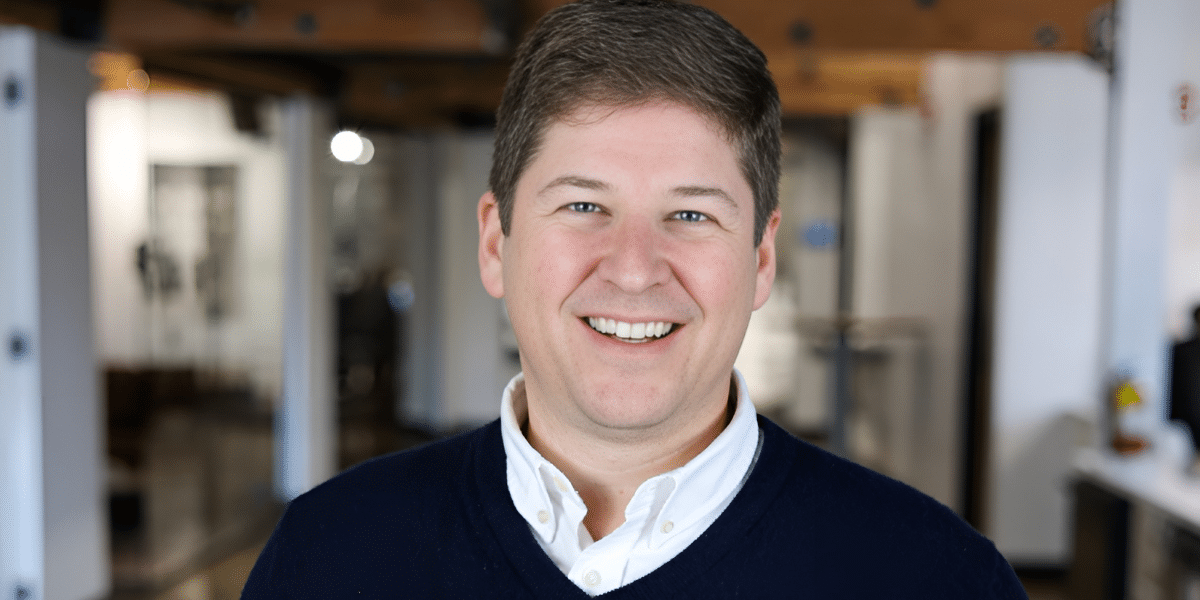

According to the company’s founder, Spencer Vann, “There is 42 billion dollars in new unclaimed money in just 7 years, which comes out to 6 billion dollars in the lost money annually, in the United States alone.”

Spencer, a natural-born entrepreneur, started a lemonade stand in kindergarten to raise money for his younger brother with severe autism who needed expensive medical treatment. His business was so successful he was featured on the cover of the local newspaper.

Spencer Vann maintained several side businesses as a kid, from carpooling kids to school for a fee, to teaching kids how to play basketball. Later in life, after shattering his ankle playing basketball, he rediscovered his love for business and began attending real estate and meetup groups. At age 19, he learned about Surplus Fund Recovery, where he began calling people to tell them they were owed money.

Realizing the lack of information online about this lucrative opportunity, Spencer Vann launched an education company called SurplusFund.com in 2017, where he taught over 5,000 students and recovered a total of an estimated $500,000,000 in money.

Spencer’s first Surplus Fund training company earned him over 7 figures in annual income, but he saw untapped potential in the industry. Rather than continuing to charge fees to teach others, he decided to invest in his client’s success and double down on their potential.

Spencer states, “Unlike Amazon and its franchises, Surplus Cashflow offers a flat fee without additional inventory or training charges. With Surplus Cashflow, clients pay the initial fee, and the company takes care of everything else. Another advantage of the service is that the first payout typically comes between 6-8 months, which is quicker than franchises.”

A surplus fund business eliminates the need to buy or oversee inventory, handle advertising expenses, or even create a website. Furthermore, you aren’t reliant on platforms such as Amazon, Walmart, or Shopify to generate revenue, making it extremely appealing to investors seeking to establish a 6-figure passive income stream to supplement their existing revenue.