The landscape of taxation in the United States is undergoing a seismic shift, thanks to the groundbreaking strategies rolled out by My BnB Accelerator. Led by industry pioneers Nick Korom and Dr. Connor Robertson, this innovative venture is helping high-income W2 employees navigate the tricky waters of taxation, enabling many to legally pay zero tax. Yes, you read that right!

At the core of this transformative journey is the unique “Seller Carry Back Method”. But what does a real estate strategy have to do with taxation? A lot, as it turns out!

Reimagining Tax Strategy for W2 Employees

Traditionally, high-income W2 employees often found themselves burdened with heavy tax liabilities. Enter My BnB Accelerator with its ingenious approach. Beyond making luxury homeownership accessible, the firm has crafted a dual-edged sword that both offers a lavish home and strategically offsets tax obligations.

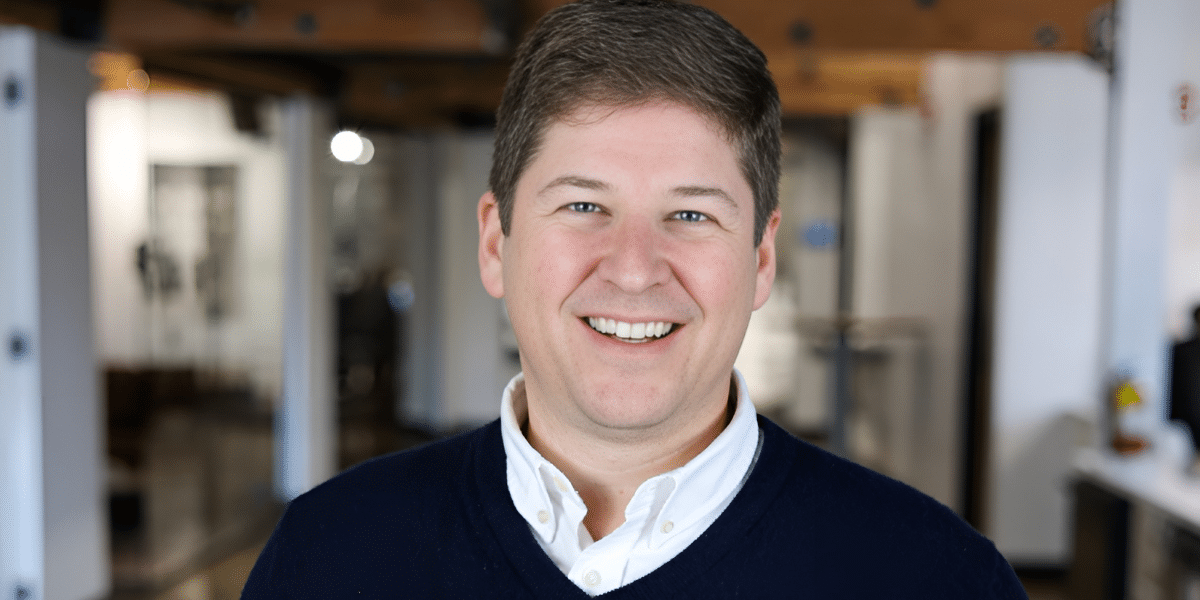

Nick Korom reflects on their vision, “We recognized a niche, a group of hardworking Americans who felt cornered by their tax bills. Our method is about breaking those barriers.”

The Legal Path to Zero Tax

Under the astute guidance of Dr. Connor Robertson, My BnB Accelerator’s method intertwines real estate investment with tax benefits. “It’s not just about smart property acquisition,” Dr. Robertson elucidates. “It’s about integrating that into a broader financial portfolio tailored to maximize tax reliefs for our clients.”

For many, this methodology has been a beacon of hope and empowerment, allowing them to not only indulge in luxury homeownership but to also retain more of their hard-earned money.

Redrawing the Tax Blueprint

My BnB Accelerator isn’t just challenging the norms; it’s setting new ones. Their avant-garde approach stands as a testament to what is possible when innovation meets deep market insight. The result? A revolutionized tax strategy for high-earning W2 employees in the U.S.

Onward and Upward

The journey has just begun. With the success of the “Seller Carry Back Method”, Korom and Robertson are determined to redefine the tax narrative for W2 employees across America. The duo’s message is clear: You can earn high, own luxury, and legally optimize your taxes.

To unravel the secrets of how My BnB Accelerator is turning the tide for high-income W2 employees, head to http://www.thesellercarrybackmethod.com/scbmethod or reach out directly at nick@mybnbaccelerator.com.